November 2, 2023

On November 1, 2023, the Internal Revenue Service issued Notice 2023-75 announcing the cost-of-living adjustment (“COLA”) applicable to pension and retirement plan dollar limitations for the 2024 calendar year. Most of the dollar limits applicable to contribution and benefit limits, including the elective contribution limit for 401(k), 403(b) and 457(b) plans, will increase from the 2023 limits. Additionally, the Social Security Administration has determined that the 2024 benefit base will be $168,600, up from $160,200 in 2023. A change in a limitation means that the increase in the cost-of-living index was sufficient enough to trigger the applicable statutory COLA.

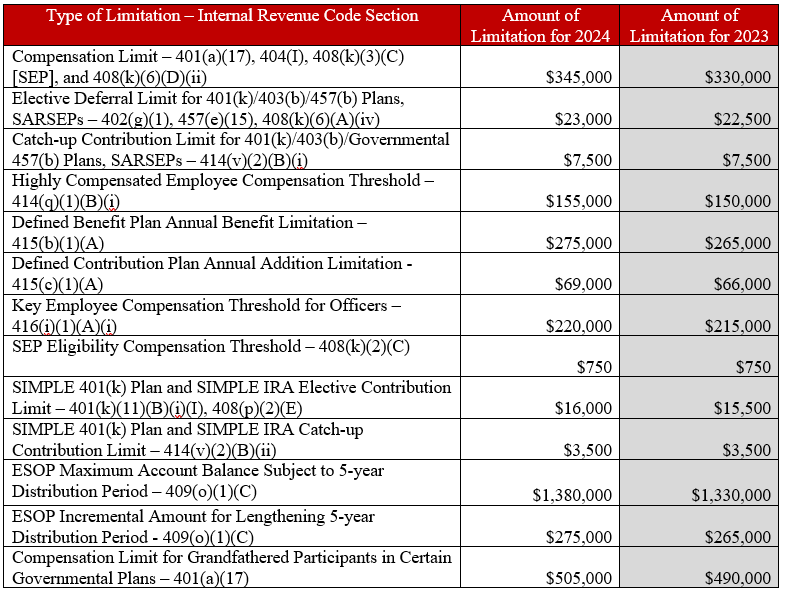

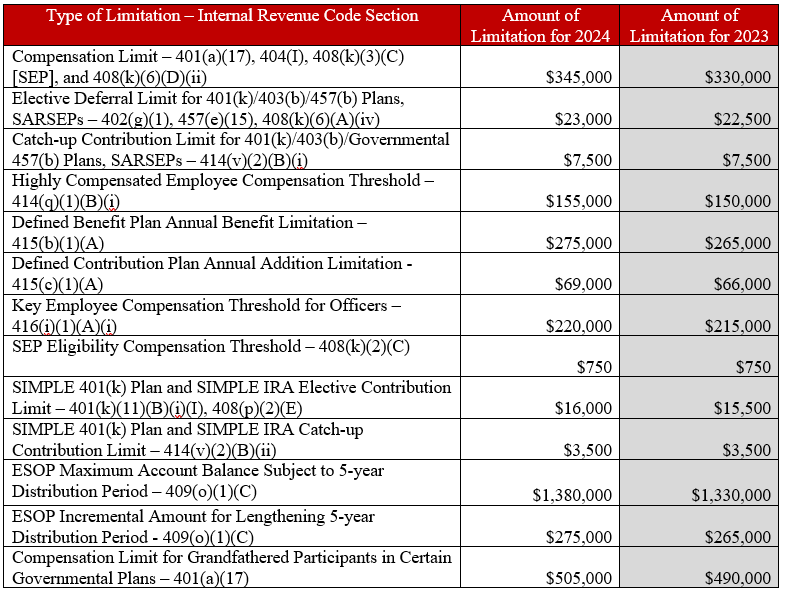

The following table summarizes many of the retirement plan limitations for the 2023 and 2024 tax years:

For further information regarding the 2024 retirement plan limitations or to discuss any other retirement or welfare plan matters, please contact any member of our Employee Benefits and Executive Compensation Practice Group.

Disclaimer: The contents of this article should not be construed as legal advice or a legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult with counsel concerning your situation and specific legal questions you may have.

Practices

November 2, 2023

On November 1, 2023, the Internal Revenue Service issued Notice 2023-75 announcing the cost-of-living adjustment (“COLA”) applicable to pension and retirement plan dollar limitations for the 2024 calendar year. Most of the dollar limits applicable to contribution and benefit limits, including the elective contribution limit for 401(k), 403(b) and 457(b) plans, will increase from the 2023 limits. Additionally, the Social Security Administration has determined that the 2024 benefit base will be $168,600, up from $160,200 in 2023. A change in a limitation means that the increase in the cost-of-living index was sufficient enough to trigger the applicable statutory COLA.

The following table summarizes many of the retirement plan limitations for the 2023 and 2024 tax years:

For further information regarding the 2024 retirement plan limitations or to discuss any other retirement or welfare plan matters, please contact any member of our Employee Benefits and Executive Compensation Practice Group.

Disclaimer: The contents of this article should not be construed as legal advice or a legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult with counsel concerning your situation and specific legal questions you may have.