November 15, 2018

The Internal Revenue Service issued Notice 2018-83 announcing the cost-of-living adjustments applicable to pension and retirement plan dollar limitations for tax year 2019. The elective deferral limit for participants who participate in 401(k), 403(b), 457(b) plans and SARSEPs has increased $500, from $18,500 in 2018 to $19,000 in 2019. The $6,000 catch-up contribution limit (for participants age 50 and over) remains unchanged.

In addition, the Social Security Administration has determined that the 2019 contribution and benefit base will increase to $132,900 for 2019, up from $128,400 in 2018. A change in a limitation means that the increase in the cost-of-living was sufficient to trigger the applicable statutory Cost-of-Living Adjustment (“COLA”).

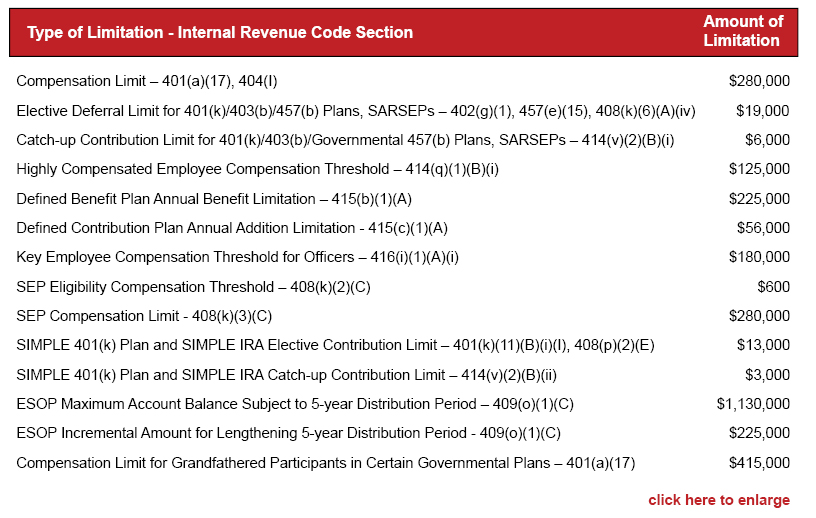

The following table provides many of the pension plan limitations for the 2019 tax year, most of which have changed:

For further information regarding the 2019 pension plan limitations or to discuss any other retirement or welfare plan matter, please contact any member of our Employee Benefits and Executive Compensation Practice Group.

Practices

November 15, 2018

The Internal Revenue Service issued Notice 2018-83 announcing the cost-of-living adjustments applicable to pension and retirement plan dollar limitations for tax year 2019. The elective deferral limit for participants who participate in 401(k), 403(b), 457(b) plans and SARSEPs has increased $500, from $18,500 in 2018 to $19,000 in 2019. The $6,000 catch-up contribution limit (for participants age 50 and over) remains unchanged.

In addition, the Social Security Administration has determined that the 2019 contribution and benefit base will increase to $132,900 for 2019, up from $128,400 in 2018. A change in a limitation means that the increase in the cost-of-living was sufficient to trigger the applicable statutory Cost-of-Living Adjustment (“COLA”).

The following table provides many of the pension plan limitations for the 2019 tax year, most of which have changed:

For further information regarding the 2019 pension plan limitations or to discuss any other retirement or welfare plan matter, please contact any member of our Employee Benefits and Executive Compensation Practice Group.